Travel insurance is a type of insurance that covers unforeseen events and expenses that may occur during a trip. It provides financial protection for travelers against accidents, illnesses, trip cancellations, lost luggage, and other potential risks.

It is essential to consider purchasing travel insurance before embarking on any trip, especially when traveling to India, a country with diverse landscapes, cultures, and potential risks for tourists.

The importance of travel insurance cannot be understated, as it offers peace of mind and financial security for travelers. In case of emergencies, having travel insurance can save you from significant expenses and potential financial burdens.

Travel insurance typically covers various scenarios, including:

- Medical emergencies during the trip.

- Trip cancellation or interruption due to unforeseen reasons.

- Lost or delayed luggage.

- Emergency evacuation.

There are different types of travel insurance to choose from, such as:

- Single trip insurance, which covers a specific trip or vacation.

- Annual multi-trip insurance, which covers multiple trips within a year.

- Backpacker insurance, which provides coverage for longer trips and activities like backpacking and adventure sports.

When selecting travel insurance for India, it is crucial to consider certain factors, such as your destination, coverage options, and exclusions. It is also essential to compare quotes from different providers, read reviews and ratings, and understand the claims process to make an informed decision.

Some additional considerations for travel insurance in India include checking for pre-existing medical conditions, considering the length of your trip, and looking for adventure or sports coverage. By carefully considering these factors, you can choose the right travel insurance that best suits your needs and provides comprehensive coverage for your trip to India.

Key Takeaways:

What Is Travel Insurance?

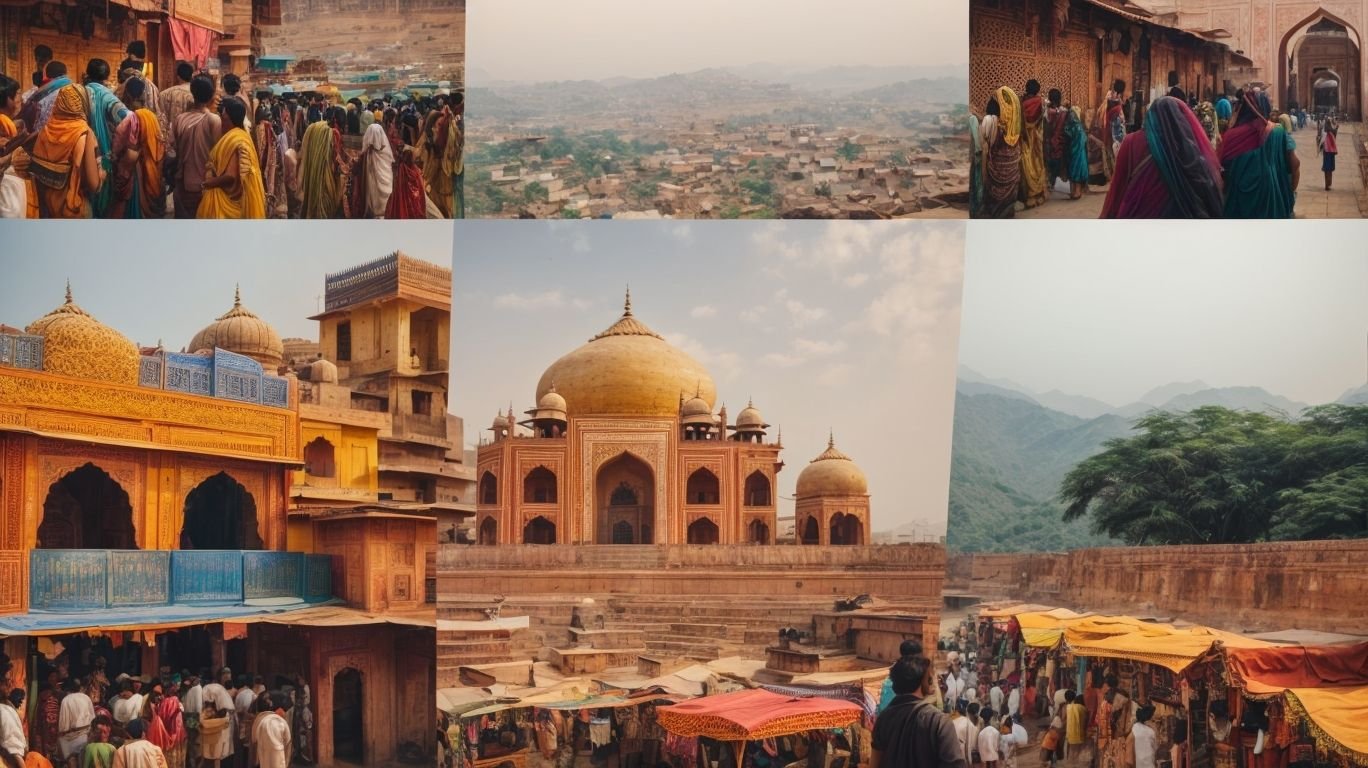

Photo Credits: Kinemastermodpro.Xyz by Arthur Clark

Travel insurance is a form of insurance that offers protection against unforeseen events that may happen while traveling. Its purpose is to safeguard travelers from financial losses and provide aid in the event of emergencies.

Typically, travel insurance covers expenses such as:

- trip cancellation or interruption

- medical costs

- lost luggage

- emergency evacuation

It may also include extra benefits like travel assistance services and round-the-clock emergency support. Before buying travel insurance, it is crucial to comprehend the policy’s coverage, exclusions, and limitations to ensure it meets your individual travel requirements.

Why Is Travel Insurance Important?

Photo Credits: Kinemastermodpro.Xyz by Arthur Hill

Travel insurance is incredibly important for your trip as it offers financial protection in case of unexpected events. It covers a range of expenses, including medical costs, trip cancellations, and lost baggage. Without travel insurance, you could be responsible for paying large sums of money out of your own pocket. For instance, if you become ill while traveling, medical bills can be extremely costly. With travel insurance, you can rest assured that you will receive the necessary medical care without having to worry about expenses.

Additionally, if your trip is canceled due to unforeseen circumstances, travel insurance will reimburse you for any non-refundable expenses. Remember to carefully review the policy to fully understand what is covered and select the appropriate coverage for your specific needs.

What Does Travel Insurance Cover?

Photo Credits: Kinemastermodpro.Xyz by Bradley Nguyen

When planning a trip, it’s important to consider the potential risks and unforeseen circumstances that may arise. This is where travel insurance comes in, providing coverage and protection for a variety of situations. In this section, we will discuss the different areas that travel insurance typically covers, such as medical emergencies, trip cancellation or interruption, lost or delayed luggage, and emergency evacuation. By understanding what travel insurance covers, you can make informed decisions and ensure a worry-free trip.

1. Medical Emergencies

During a trip, facing a medical emergency can be stressful. To ensure you are prepared, follow these steps:

- Research insurance providers that offer comprehensive coverage for medical emergencies.

- Compare the coverage options, including emergency medical expenses, hospitalization, and medical evacuation.

- Check the policy’s exclusions, such as pre-existing medical conditions or injuries from adventure sports.

- Consider the length of your trip and select a policy that provides coverage for the entire duration.

- Read reviews and ratings of different insurance providers to assess their reliability and customer satisfaction.

- Understand the claims process and the necessary documentation for filing a claim.

By following these steps, you can ensure that you have sufficient coverage for any medical emergencies that may arise during your trip to India.

2. Trip Cancellation or Interruption

Trip cancellation or interruption coverage is an essential component of travel insurance. It provides protection for travelers in case they need to cancel or cut short their trip due to unforeseen circumstances. This coverage typically includes reimbursement for non-refundable expenses such as flights, accommodation, and tours. Common reasons for trip cancellation or interruption include illness, injury, natural disasters, or job loss.

Before purchasing travel insurance, it is crucial to carefully review the policy details, including any exclusions or limitations, to ensure that you have the necessary coverage to protect your investment in case of unexpected events.

3. Lost or Delayed Luggage

When it comes to travel insurance, one of the essential coverage options is protection against lost or delayed luggage. Here are some steps to consider:

- Document your belongings: Take photos and make a list of items packed.

- Use identification tags: Attach durable luggage tags with your contact information.

- Keep valuables with you: Carry important documents, electronics, and valuable items in your carry-on.

- Secure your luggage: Lock your bags and use tamper-evident seals for added protection.

- Report immediately: If your luggage is lost or delayed, report it to the airline or transportation provider.

- Keep receipts: Save receipts for essential items purchased due to lost or delayed luggage.

- File a claim: Contact your travel insurance provider to initiate the claims process for lost or delayed luggage.

4. Emergency Evacuation

Emergency evacuation coverage is a crucial aspect of travel insurance that should not be overlooked. This type of coverage provides assistance and financial protection in case of a medical emergency or natural disaster, including transportation, medical care, and repatriation.

To ensure you have the right travel insurance with emergency evacuation coverage, follow these steps:

- Thoroughly review the coverage limits and conditions for emergency evacuation.

- Make sure that the coverage includes both medical evacuation and non-medical evacuation.

- Check if the coverage extends to your specific destination(s), especially if you plan to visit remote or high-risk areas.

- Carefully read and understand the terms and conditions, including any exclusions or limitations.

Remember, having emergency evacuation coverage can provide peace of mind and financial security in case of unexpected events.

What Are the Different Types of Travel Insurance?

Photo Credits: Kinemastermodpro.Xyz by John Allen

When planning a trip to India, it’s important to consider the potential risks and uncertainties that may arise during your travels. This is where travel insurance comes in, offering financial protection and peace of mind in case of any unforeseen events. In this section, we will discuss the various types of travel insurance available for your trip to India. From single trip insurance for a one-time journey, to annual multi-trip insurance for frequent travelers, and even backpacker insurance for those on a budget – there are options to suit every traveler’s needs.

1. Single Trip Insurance

Single trip insurance is a type of travel insurance that provides coverage for a specific trip, typically lasting up to one year.

- Assess your travel needs: Determine the length of your trip and the destinations you plan to visit.

- Research insurance providers: Compare quotes and coverage options from different insurers.

- Consider the coverage: Look for coverage for trip cancellation, medical emergencies, lost luggage, and other relevant aspects.

- Check the policy exclusions: Understand what is not covered by the insurance to avoid any surprises.

- Read reviews and ratings: Get insights from other travelers about their experiences with specific insurance providers.

Remember to carefully review the policy terms and conditions before purchasing single trip insurance to ensure it meets your specific needs and provides adequate coverage for your trip.

2. Annual Multi-Trip Insurance

Annual multi-trip insurance is a convenient option for those who frequently travel, providing coverage for multiple trips within a year. If you are considering this type of travel insurance in India, follow these steps:

- Assess your travel frequency: Determine if you take multiple trips a year for work or leisure.

- Evaluate cost-effectiveness: Calculate the potential savings compared to purchasing separate insurance for each trip.

- Review coverage limits: Ensure that the policy offers adequate coverage for medical expenses, trip cancellation, and other necessary protections.

- Consider trip duration: Confirm that each individual trip falls within the allowed duration specified by the insurance provider.

- Check for exclusions: Understand any specific exclusions or limitations that may apply to annual multi-trip insurance.

- Compare policies: Research and compare multiple insurance providers to find the most suitable coverage and pricing for your needs.

3. Backpacker Insurance

Backpacker insurance is specifically designed for travelers who plan to go on extended trips or participate in adventurous activities. When selecting backpacker insurance, it is important to follow these steps:

- Assess your needs: Determine the length and type of your trip to find a policy that meets your specific needs.

- Check medical coverage: Make sure that the insurance includes comprehensive medical coverage for emergencies and accidents.

- Evaluate adventure coverage: Confirm that the insurance covers activities such as hiking, trekking, and water sports.

- Review trip cancellation coverage: Look for coverage that reimburses prepaid expenses in case your trip is canceled or interrupted.

- Consider personal belongings: Ensure that the insurance covers lost or stolen belongings, including valuable items like cameras and electronics.

How to Choose the Right Travel Insurance for India?

Photo Credits: Kinemastermodpro.Xyz by Frank Williams

If you are planning a trip to India, having travel insurance can offer peace of mind and financial protection in case of any unexpected events. However, with so many options available, it can be overwhelming to choose the right travel insurance for your trip. In this section, we will discuss the key factors to consider when selecting travel insurance for India, such as your destination, coverage options, and exclusions to ensure you make the best decision for your specific needs.

1. Consider Your Destination

When choosing travel insurance for India, it is crucial to consider your destination. Here are some steps to help you make the right choice:

- Research the healthcare facilities and quality of care in your chosen destination.

- Check if your destination requires specific coverage, such as medical evacuation.

- Consider the risk of natural disasters, political instability, or civil unrest at your destination.

- Assess the crime rate and safety conditions at your destination.

Suggestions:

Based on your destination, opt for comprehensive coverage that includes medical expenses, trip cancellation, and emergency evacuation. Review your policy to ensure it covers any specific risks associated with your destination. Keep a copy of your policy and emergency contact numbers handy while traveling.

2. Look at the Coverage Options

When considering travel insurance options in India, it is crucial to take into account your specific needs and preferences. Here are some steps to guide you in making an informed decision:

- Identify your travel activities and destinations to determine the necessary coverage.

- Review the medical coverage to ensure it meets your requirements, including emergency medical expenses and evacuation.

- Check the coverage for trip cancellation, interruption, and delay, considering the maximum reimbursement amount.

- Assess coverage for lost or delayed luggage, including the reimbursement limit and any exclusions.

- Consider additional coverage options for activities such as adventure sports or rental car accidents.

Fact: Did you know that travel insurance can also provide coverage for legal assistance and emergency travel assistance services?

3. Check the Exclusions

When purchasing travel insurance for India, it is crucial to thoroughly check the exclusions to ensure that you have the coverage you need. Here are some steps to help you in this process:

- Read the policy document carefully to identify any specific exclusions.

- Pay attention to any activities or sports that may be excluded from coverage.

- Be sure to check for any pre-existing medical conditions that are not covered.

Remember, understanding the exclusions will help you avoid any surprises or gaps in coverage during your trip. Pro-tip: If you have any questions or concerns about the exclusions, don’t hesitate to reach out to the insurance provider for clarification.

What Are Some Tips for Buying Travel Insurance in India?

Photo Credits: Kinemastermodpro.Xyz by Paul Hall

Planning a trip to India? Along with booking flights and accommodations, it’s important to also consider purchasing travel insurance. But with so many options available, how do you know which one to choose? In this section, we will discuss some important tips for buying travel insurance in India. From comparing quotes to understanding the claims process, we’ve got you covered. Keep reading to ensure you make the best decision for your trip.

1. Compare Quotes from Different Providers

When purchasing travel insurance in India, it’s important to compare quotes from different providers to ensure you get the best coverage at the most affordable price. Here are some steps to help you compare quotes:

- Identify your coverage needs – consider the duration of your trip, destination, and activities you plan to engage in.

- Research insurance providers – look for reputable companies with a strong track record and positive customer reviews.

- Request quotes – reach out to multiple providers and provide them with the necessary information to get accurate quotes.

- Compare coverage – carefully review the coverage options, including medical expenses, trip cancellation, baggage loss, and emergency evacuation.

- Consider the cost – compare the premiums, deductibles, and any additional fees to determine the overall cost of the insurance.

- Read the fine print – carefully review the policy terms, conditions, and exclusions to ensure you understand what is covered and what is not.

- Make an informed decision – based on the comparison, choose the insurance provider that offers the most comprehensive coverage at a competitive price.

2. Read Reviews and Ratings

When purchasing travel insurance in India, it is crucial to read reviews and ratings to make an informed decision. Here are some steps to help you navigate this process:

- Research reputable insurance providers and compare their reviews and ratings.

- Read customer feedback to understand their experiences with the insurance company, including their reviews and ratings.

- Look for reviews that specifically mention the coverage and claims process.

- Consider the overall rating of the insurance provider and the number of positive reviews.

- Pay attention to any negative reviews and assess if they are relevant to your specific needs and concerns.

- Take into account any recommendations or endorsements from trusted sources or travel forums.

By following these steps and considering reviews and ratings, you can make a well-informed decision when choosing travel insurance in India.

3. Understand the Claims Process

Understanding the claims process is crucial when purchasing travel insurance in India. Follow these steps for a smooth claims experience:

- Read and understand the policy document carefully to fully comprehend the claims procedure.

- Report the incident to the insurance provider as soon as possible.

- Provide all necessary documents, such as medical reports, police reports, and receipts.

- Fill out the claims form accurately, including all required details.

- Cooperate with the insurance company during the investigation process.

- Keep copies of all documents and communication with the insurer.

- Follow up with the insurance company for updates on the claim status.

- If the claim is denied or not settled satisfactorily, escalate the matter to the insurance ombudsman or regulatory authorities if necessary.

What Are Some Additional Considerations for Travel Insurance in India?

Photo Credits: Kinemastermodpro.Xyz by Benjamin Baker

When planning a trip to India, it’s important to consider all aspects of your travel, including insurance. While basic travel insurance typically covers common issues like trip cancellation or lost luggage, there are additional considerations to keep in mind for traveling in India. In this section, we will discuss some important factors to consider when choosing a travel insurance plan, such as pre-existing medical conditions, trip length, and coverage for adventure or sports activities. By understanding these factors, you can ensure that you have comprehensive coverage for your trip to India.

1. Check for Pre-Existing Medical Conditions

When purchasing travel insurance in India, it is crucial to check for any pre-existing medical conditions to ensure proper coverage and avoid any potential issues.

- Review your medical history: Carefully assess your medical records and consult with your healthcare provider to identify any pre-existing conditions.

- Disclose all medical conditions: Make sure to disclose all relevant information about your pre-existing medical conditions when applying for travel insurance.

- Understand coverage limitations: Be aware of any coverage limitations or exclusions related to pre-existing conditions in your travel insurance policy.

- Consider specialized coverage: If you have specific medical needs, such as chronic illnesses or ongoing treatments, consider seeking out specialized travel insurance plans that provide comprehensive coverage for your condition.

- Compare policies: Compare different travel insurance policies to find the one that offers the best coverage and benefits for your pre-existing conditions.

Remember, being transparent about your pre-existing medical conditions is essential to ensure that you receive appropriate coverage and support during your travels in India.

2. Consider the Length of Your Trip

When selecting travel insurance for your trip to India, it is important to take into account the length of your stay to ensure that you have sufficient coverage. To help you make the best decision, here are some steps to consider:

- Assess the duration of your trip, including both the departure and return dates.

- Determine if you need coverage for a specific number of days or if you require a policy that covers multiple trips within a specific timeframe.

- Consider if your trip includes any extensions or side trips that may require additional coverage beyond the initial duration.

- Review the policy’s maximum trip length to ensure that it aligns with your travel plans.

- Check if there are any restrictions or limitations on the coverage based on the length of your trip.

Considering the length of your trip will help you choose the right travel insurance policy that offers sufficient coverage for the entire duration of your stay in India.

3. Look for Adventure or Sports Coverage

When buying travel insurance in India, it is crucial to take into account coverage for adventure or sports activities. Here are the necessary steps to follow:

- Identify the specific adventure activities or sports you plan to participate in during your trip.

- Check if the insurance policy you are considering covers these activities.

- Make sure that the coverage includes medical expenses, emergency evacuation, and trip cancellation related to adventure or sports activities.

- Carefully read the terms and conditions of the policy to understand any exclusions or limitations related to adventure or sports coverage.

- If your chosen insurance policy does not provide sufficient coverage for adventure or sports, consider purchasing additional coverage specifically for these activities.

Frequently Asked Questions

Is travel insurance required for a trip to India?

While travel insurance is not required for a trip to India, it is highly recommended.

What are some common reasons to purchase travel insurance for a trip to India?

Some common reasons to purchase travel insurance for a trip to India include flight cancellation, missed flight connections, baggage coverage, medical emergencies, and financial help in case of unforeseen situations.

What type of coverage is available for a trip to India?

Depending on the insurance provider, there are various types of coverage available for a trip to India such as standard trip cancellation, cancel for any reason, optional add-ons, and specialized plans for senior citizens or long haul flights.

Are dental emergencies covered under travel insurance for India?

Dental emergencies may be covered under travel insurance for India, but it is best to check with the insurance provider for specific details and coverage options.

Can I add additional travelers to my travel insurance policy for a trip to India?

Yes, you can add additional travelers to your travel insurance policy for a trip to India. However, the cost of the policy may vary depending on the number of travelers and their ages.

Are there any time sensitive rules for purchasing travel insurance for a trip to India?

Yes, there may be time sensitive rules for purchasing travel insurance for a trip to India. Some insurance providers may only offer coverage if the policy is purchased before the initial trip deposit or a certain number of days before the trip. It is important to check with the insurance provider for specific rules and deadlines.